IRS 7004 - Business Tax Extension Form

Form 7004 is an application for an automatic extension of time to file certain business income tax returns.

It is important for businesses to file income tax returns with the IRS every year to report their income, tax, and deductions. Some businesses have this filing deadline by March 15 and some have by April 15 to E-File Form 7004. This deadline will be based on the organization formation type and the tax year.

Visit here to find your 2023 business tax extension deadline.

Some businesses might need additional time to prepare this information to report with the IRS and for which the IRS has made this extension Form 7004 available for the businesses. By requesting an extension using IRS 7004 Form, IRS will grant the businesses an automatic 6-month extension of time to file business income tax returns.

Visit https://www.expressextension.com/form7004extension/business-tax-extensions/ to know more about the filing requirements for business tax extension Form 7004 in detail.

Note: The extension of time is only to file the tax return and not for the payments. Any balance due of the original tax return has to be paid along with the extension request. To know more about Form 7004 Instructions, Click Here!

What is the information required for E-File Form 7004?

You have to provide the below informations for filing Form 7004

- Business Name, EIN, & Address of your Business

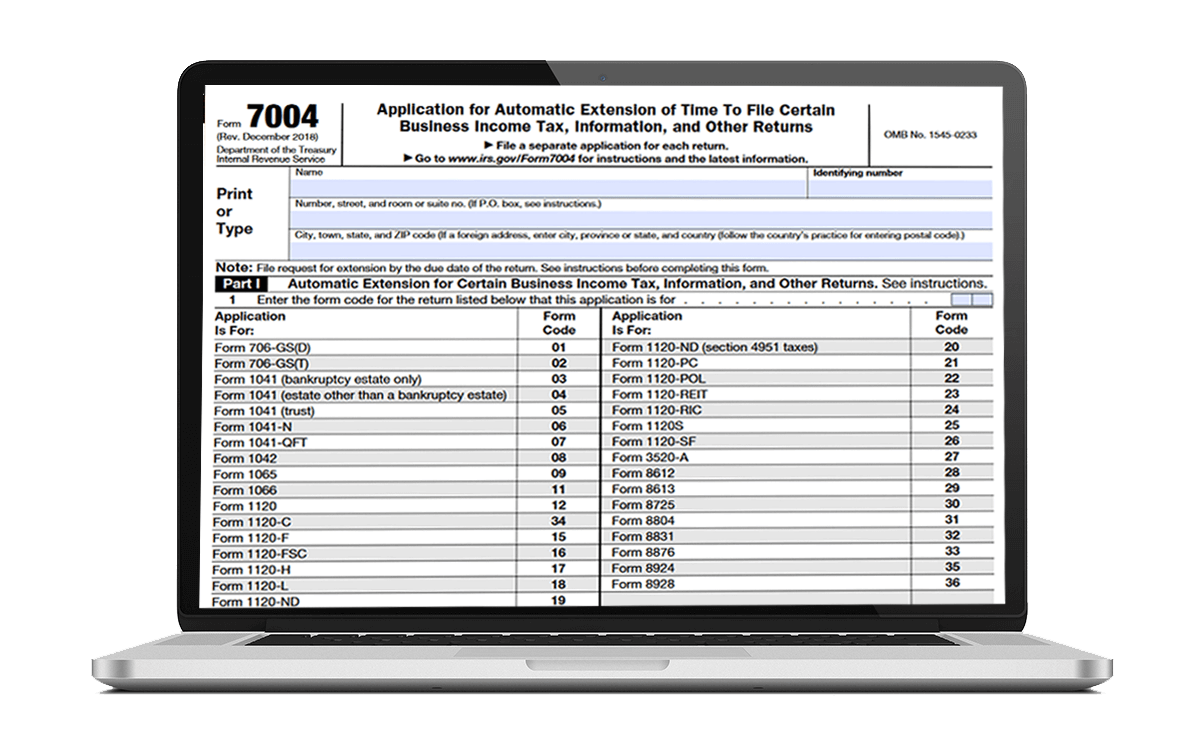

- The type of Tax Form, You are required to apply extension

- Estimated amount of the taxes you owe, if applicable

About irs7004.net

Get started with irs7004.net, an IRS-authorized e-file Provider to file 7004 online. The ExpressExtension cloud-based program will walk you through the step-by-step filing process and help you complete the E-File form 7004 filing in minutes.

You will receive an email notification once the IRS processes your business tax extension request. You can also opt to receive notifications via mobile or fax.

In case, if the IRS rejects your extension request, you will be prompted with a way to correct the errors and resubmit your extension request again with the IRS.

Why you should choose irs7004.net to E-file 7004 Form?

- Quick Processing

- Instant IRS Approval

- Complete filling in a few minutes

- Pay balance due using EFW or EFTPS

- File conveniently from any device

- Re-transmit rejected return for Free

How can I file a Business Tax Extension, IRS Form 7004 for the 2023 Tax Year?

You have to provide the below informations to file 7004 online

- Step 1: Enter Business Details

- Step 2: Choose Your Business Type & Extension Form

- Step 3: Enter Your Tentative Tax Payment Details

- Step 4: Review your Form

- Step 5: Transmit your Form 7004 to the IRS

IRS7004.net is the top IRS-approved e-file provider providing a cloud-based, safe, and secure platform to file business tax Extension Form 7004.

Helpful Resources

What is Form

7004?

Learn more

Form 7004 Instructions

Learn moreForm 7004 Mailing Address

Learn moreState Business Tax Extension

Learn moreS Corporation Tax Extension

Learn moreCorporate Tax Extension

Learn moreExtension for

LLC

Learn more

Partnership Tax Extension

Learn moreFrequently Asked Questions

- What is an Electronic Postmark?

- I e-filed my 7004 extensions, and the IRS rejected it. How much time do I have to correct it?

- How do I find my estimated tax amount?

- https://support.expressextension.com/art/11742/what-is-name-control

- <What are the common reasons for 7004 rejection?

Contact Us

For any questions about filing Form 7004 online, you can access our knowledge-base or reach out to our customer service by dialing 803.514.5155 or email your inquiries to support@expressextension.com.

We also support other federal extension forms such as Form 4868, Form 8868, Form 8809. Visit ExpressExtension.com to know more!